Politics: A little perspective on this whole deficit mess

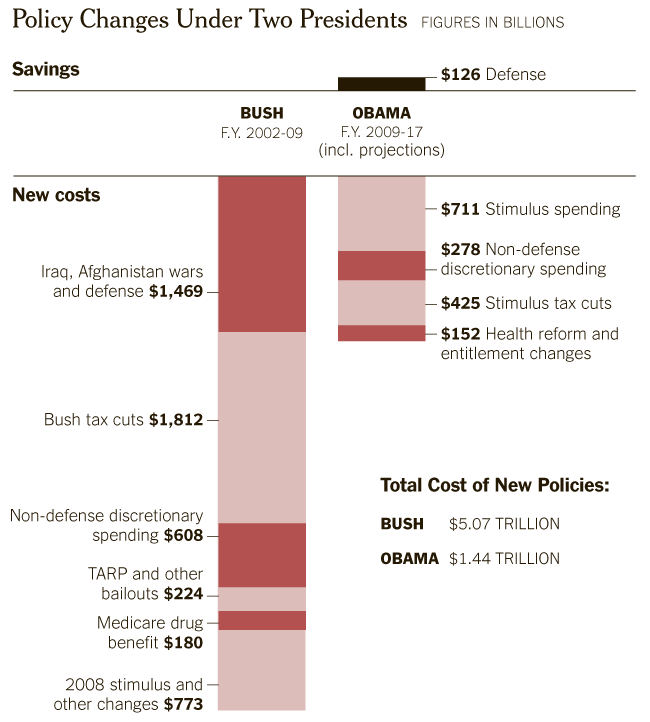

- This graph, courtesy of the New York Times, has been making the rounds today, and it’s worth examining. Note that health care reform, much-maligned by the right as deficit-killer, cost less than even the most inexpensive of George W. Bush’s policies (that policy being Medicare Part D). Note also that the Bush tax cuts alone added more to the deficit than all of President Obama’s new policies combined — and that’s including projected spending over the course of a theoretical second term. source