- 240 mile march by Occupy Wall Street, from NYC to DC source

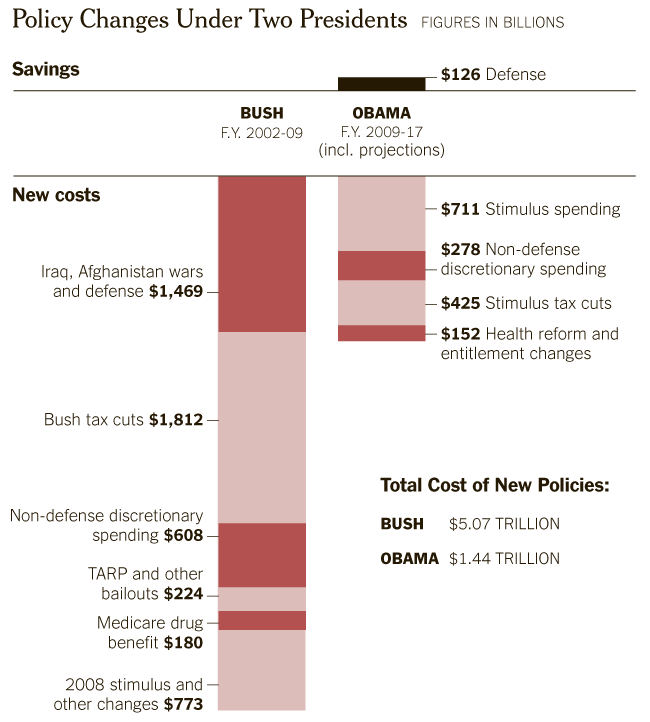

- » Hitting the road: A group of OWS protesters have embarked on this lengthy walk, expecting to arrive in Washington DC on November 23rd, the congressional committee deadline on whether to keep the Bush-era tax cuts extensions President Obama agreed to last year. The Occupy movement, obviously, would like to see these cuts expire; while this would raise the tax burden of middle-income Americans to a remote extent, it would also cause a very large influx of revenue from the class most buoyed by the Bush tax policy — that vaunted 1%. The march consists of a mere dozen or so protesters right now, but they expect (we suspect rightly) to gain large numbers as they work their way towards the capitol.