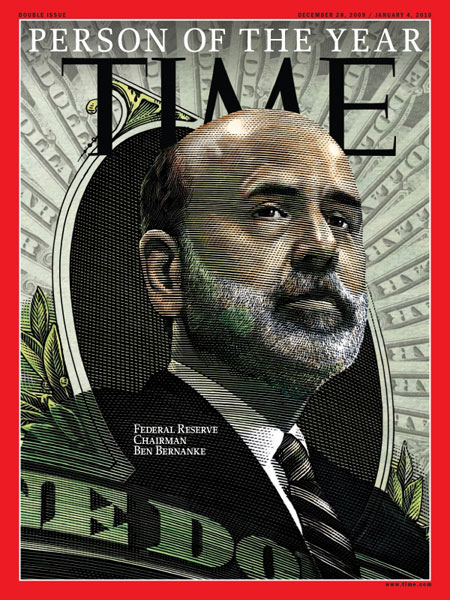

Politics: Ben Bernanke? Time’s Person of the Year pick doesn’t impress us

- How worthy is this choice? We realize why some might consider the choice of the Federal Reserve Chair just, but we argue even if you’re gonna go that route, Timothy Geithner and numerous CEOs have claim on this mantle. It’s an iffy choice at best. source