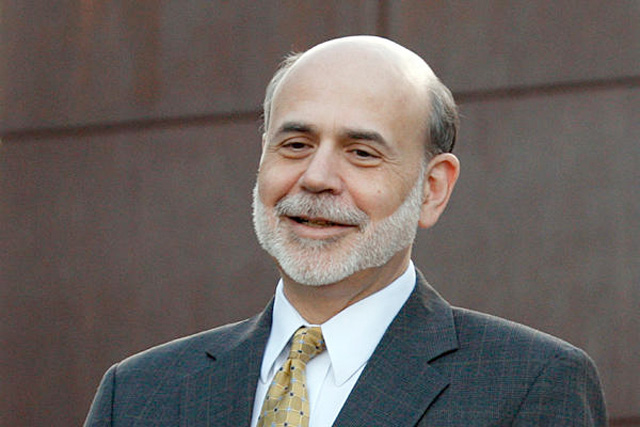

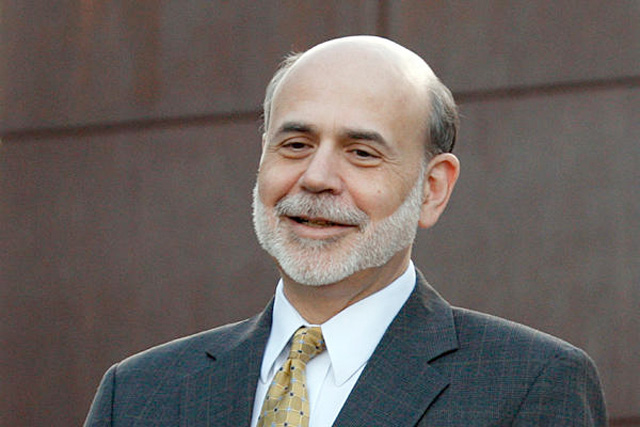

- Working the crowd: Bernanke told reporters that his decision to hold this first-ever event was part of his effort to increase transparency at the Federal Reserve. On the issues, though, Bernanke was less a revelatory messenger than that of a lot of news we sort of already knew — unemployment is high, inflation is a risk as always (though one he sought to downplay), the deficit is unsustainable, and the Fed will be broadly staying the course with its monetary policies. That said, we want to give him some credit. First, the Federal Reserve has been a very secretive organization throughout its life, and Bernanke’s effort in making himself more available is admirable. Second, that might be the best damn beard in all of central banking. source