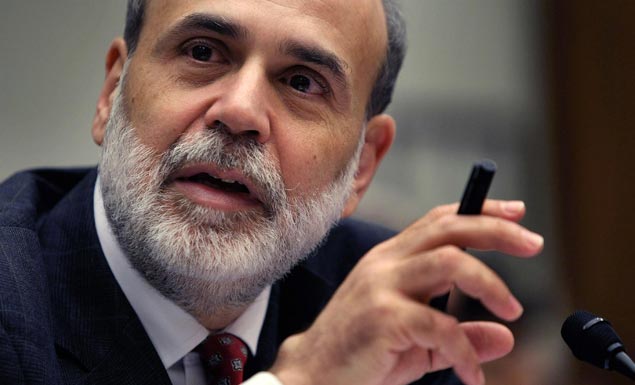

U.S.: Ben just got Bernanke’d by Bernie Sanders. Ouch.

- Yeah … Our boy’s gonna have trouble getting a second term. Ben Bernanke’s first term as Federal Reserve chair was marked by a whole bunch of crazy bank failures, financial market distress, bailouts, and pissed-off tea partiers who probably want to hurt him. On the eve of a second confirmation hearing, one independent senator has said “enough.” Bernie Sanders plans to put a hold on Bernanke’s nomination, which means he might be able to filibuster easily. He’s pretty much screwed. source